Financial inclusion of Palestinian refugees

This is part three of four short reviews from a consolidated article by Oussama Baher, investigating the lack of financial and social inclusion for Palestinian refugees in Lebanon and advocating that the rewards for financial inclusion of refugees outweigh the disadvantages any government may fear.

According to the UNRWA Protection Brief report published in 2020, “Palestine refugees in Lebanon face substantial challenges to the full enjoyment of their human rights. They are socially marginalized, have very limited civil, social, political and economic rights, including restricted access to the Government of Lebanon’s public health, educational and social services and face significant restrictions on their right to work and right to own property” (UNRWA, 2020). Knowing the discriminatory treatment they face, it is no surprise that Palestinian Refugees have a clear lack of access to the banking system.

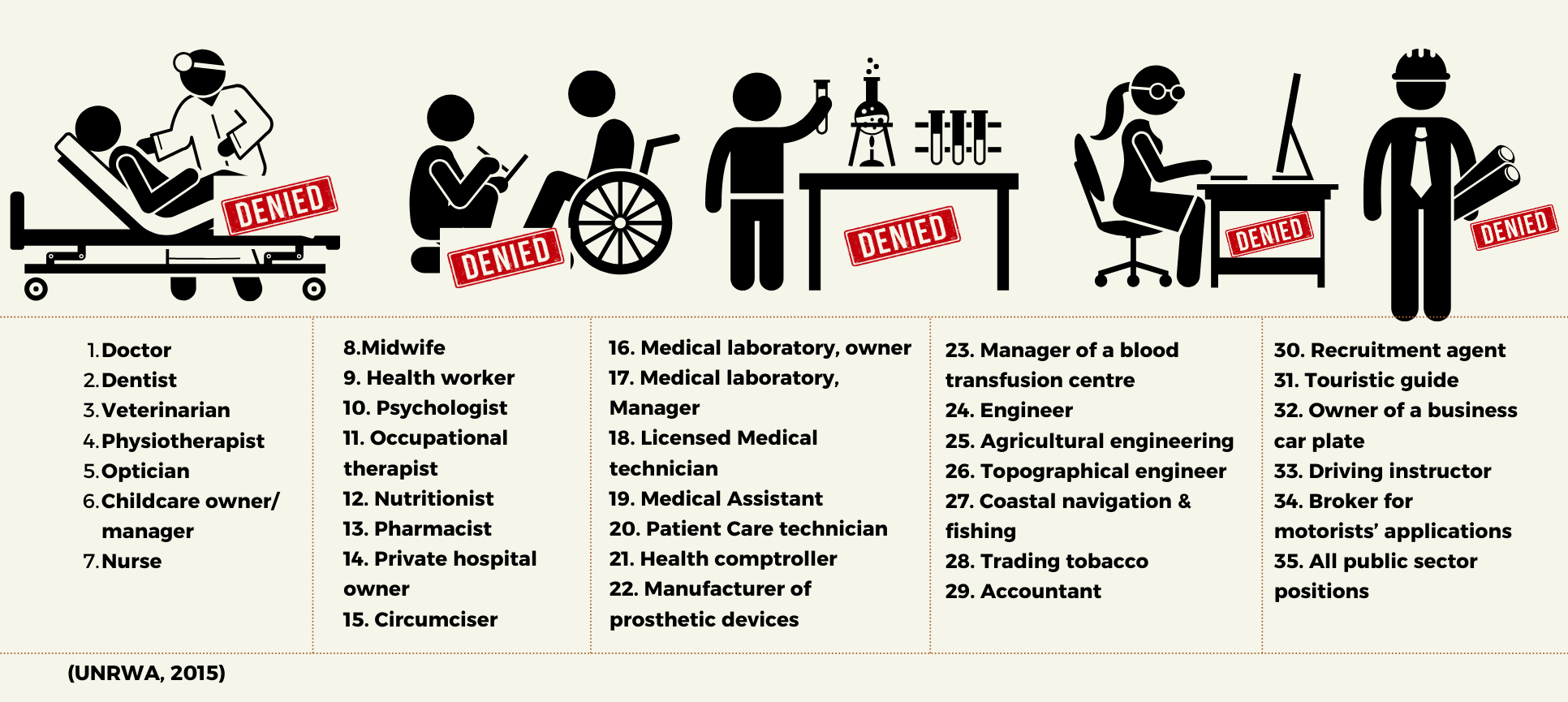

Jobs that Palestinian refugees in Lebanon are not allowed to apply for (LMRD, 2015)

When it comes to financial services, Palestinians are denied access to basic financial services in Lebanon such as opening a bank current or saving account. While there is no Lebanese Law prohibiting international migrants or refugees from opening a bank account, Syrians and Palestinians face discriminatory practices when it comes to financial services and official transactions, mainly for social or political reasons. In normal circumstances, banks require the client to be legally residing in the country and clarify the source of income to be deposited (some banks require a minimum deposit). There is also no mention of the type of passport to be held by the applicant as long as it’s a valid form of ID.

Given the long history of the crisis, most Palestinian refugees are registered with the Lebanese authorities and hold valid documents that allow them to open bank accounts. Nevertheless, Lebanese banks use Anti Money Laundering regulations (AML) as an excuse to prevent most refugees getting access to the financial system, even when a clear source of income has been provided. It is worth noting however that regulators around the world have been working hard to revise regulations, allowing more flexibility to banks around the world to be more inclusive to marginalised communities such as refugees.

Apart from opening a bank account, raising finances through personal or business loans is also not possible. Although it’s difficult to analyse whether this is due to the financial crisis in Lebanon or because they are identified as ‘high risk’ recipients with questionable capacity to meet repayment obligations, Palestinian refugees have not been allowed credit services even before the crisis. From a risk management standpoint, banks might be hesitant in giving out loans to high-risk households regardless of whether they are refugees or citizens. By contrast, allowing current or checking accounts to be opened is virtually risk-free to these institutions. To put it simply, only money deposited is the money to be transferred and used.

The facts about financial exclusion in Lebanon (UNRWA, 2015)

Despite being an important element in improving the financial health of Palestinian refugees, and some success being enjoyed as a result of interventions by existing NGOs in Lebanon who work successfully and closely with high-risk household credits including refugees, financial inclusion alone is surely insufficient in the absence of a clear reform to the status of Palestinian refugees in Lebanon, including their social and economic rights and obligations. A proper integration can unlock great benefits to the Palestinian refugees and Lebanon’s development, as highlighted in the following chapter.